BOTSWANA: Aim to procure 645MW by 2026

after years of challenges and delay, the power sector appears to finally be on a positive trajectory. Botswana power Corporation has an investment grade credit rating from Moody’s, good progress is being made on several long-term projects, and there is optimism about BpC’s attempts to procure solar power, writes Dan Marks

Mineral resources, green technology and energy security minister Lefoko Moagi has said Botswana will look to procure 645MW of new capacity by 2026. Moagi made the comments in parliament in August while presenting his ministry’s proposals for the mid-term review of the country’s National Development Plan (NDP).

Regulatory reforms and a turnaround programme at Botswana Power Corporation (BPC) were followed by a tariff increase earlier this year. Moagi said peak demand was 600MW, with annual demand of 3,290GWh across all sectors.This is expected to increase to up to 1,445MW and 8,637GWh/yr in 2040, assuming average GDP growth of 3.6%/yr. Botswana relies on

old or poorly functioning coal power plants and imports to meet its electricity needs, but the NDP aims for self-reliance and diversification in the power sector, with “competitive, cost- reflective and sustainable electricity”, Moagi said

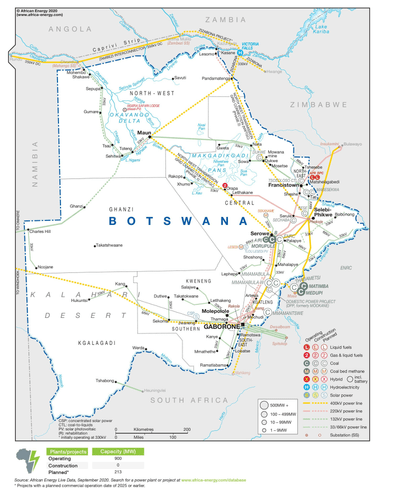

The long-delayed refurbishment to the Morupule A coal power plant which began in December 2015 was completed in February, with the plant delivering 104MW consistently to the grid. Moagi said the North West Transmission Grid Line project was 90% complete and should begin operating in December. The project will reduce reliance on diesel power for mines in the region, extending the high-voltage network from the 600MW Morupule B coal power plant to Maun, Shakawe and Ghanzi via Orapa. Ghanzi and Shakawe are currently dependent on imports from Namibia.Work on transmission is also ongoing in the south of the country, with three new substations at Mochudi, Tlokweng and Ramotswa scheduled to begin operating later this year and next year

Progress has also been made with rural electrification – 402 of 492 villages under the Village Electrification Programme now have a power supply and 72 villages were connected to the grid in 2019-20, meaning that 90% of rural villages have electricity, Moagi said

Morupule B continues to be a drag on the sector. Only two of the plant’s four units are operating, producing only 230MW overall. Remedial work on Unit IV which had been scheduled for completion earlier this month has been delayed by the contractor declaring force majeure in February as it was unable to bring staff from China. The plant’s 32% availability was a major cause of imports being 231% more than forecast in the year to 31 March, contributing to losses at BPC of P1.5bn ($131m). BPC had forecast a profit of P551m.

Moagi said the government has commissioned a prefeasibility study on the development of a coal-to-liquids project. A full feasibility study is under way with the aim of breaking ground on the project by 2025.Three strategic fuel storage facilities are also being built: the 186m litre Tshele Hills project, the 35m litre Ghanzi project, and the expansion of the Francistown facility to 60m litres

A new 20-year Integrated Resource Plan (IRP) was approved by cabinet last month, although it has not yet been published. The document, which sets out the country’s least-cost development path, has been under preparation since January 2019. To meet the seven-year demand forecast in the IRP, Moagi pointed to the ongoing procurement of two 50MW solar PV plants and 35MW from 12 smaller solar projects from the Accelerated Green Energy Initiative, all to be commissioned by 2022. Tlou Energy’s 10MW coal bed methane project was also included and will begin operating by 2025. The larger 100MW Sekaname coal bed methane project was not mentioned. Alongside these existing projects, BPC will procure a 200MW concentrated solar plant, to be operational by 2026, Moagi said. Procurement is scheduled to begin early next year.

Moagi said procurement of 300MW of coal power, also for operation by 2026, is under way, but most industry analysts are sceptical about the likely success of the plan. Posco and Marubeni were selected to build the 300MW Morupule B units V-VI as an IPP in 2016, when financing conditions were much more conducive to coal power development as Organisation for Economic Cooperation and Development rules preventing export credit agencies lending to coal projects had not yet come into force. Kepco and Daewoo were awarded the 300MW Morupule B unitsVII-VIII soon after. However, neither project has gone ahead after the government made clear it would not provide a sovereign guarantee (AE 362/4).

Pula-denominated power purchase agreements (PPAs) are also likely to prove a challenge for large coal power plants. One source close to the Morupule B IPPs said the pula financial markets are not large enough to finance a 300MW coal power project, meaning that international financing would have to be found. With most development finance institutions (DFIs) no longer financing coal power projects, it is not clear where international funding could come from without a sovereign guarantee.

Solar procurement

However, bidders are optimistic about the current solar PV procurement. BPC is running a tender process for two IPPs at pre-selected sites, one at Jwaneng in Southern District and the other at Selebi-Phikwe in the Central District. Both have good solar irradiation, although the strongest sunlight is found in the more remote north-west of the country.The plants are located close to the end of medium-voltage lines some distance from Morupule B and are therefore likely to help with grid stability.

With sites pre-selected and a PPA already established, bidders hope the tender will avoid the long delays, sudden rule changes, and extended negotiations that have derailed previous efforts. One frustrated adviser to an older coal IPP in the country told African Energy:“Botswana has not done itself any favours with previous procurement processes that have all ended up being aborted for one or the other reason. It is a pity because people tend to consider Botswana low risk in the conventional sense, but the risk of dealing with a government which acts irrationally and inconsistently like in Botswana often gets overlooked

“All of that said, I think the intention on the solar side is probably genuine and a process will in all likelihood go ahead. We will have to see how the market responds this time. I do not believe in any coal-fired tender process at the moment and the universe of parties interested in such is also shrinking by the day, both on the developer and financier side.”

The coal bed methane tender process has also been challenging. Two companies, Tlou Energy and Sekaname Ltd, were shortlisted in 2017 but asked to re-tender in February 2018 (AE 394/7). After submitting bids in October 2018, both projects were selected as preferred bidders in June 2019. Deadlines were missed for signing a full 30-year PPA, leaving Tlou to sign interim PPA for a 2MW pilot project in April this year, with a 15-year generation licence issued in June.

Botswana has taken the unusual step of requiring bidders in all its public IPP tenders to sign non-disclosure agreements, meaning public information on the tender is limited. However, one stakeholder who has seen the tender documents told African Energy:“It’s not perfect, there were some flaws in the tender but by and large I think it could work. Bids are due next month and I think there are going to be not as many bids as there were in South Africa, but there are going to be a few bidders.”

The deadline for opening bids has been put back several times and is now expected in the second half of October. Bidders remain confident in the process, however, with changes to deadlines well communicated.There is some patience with the government as it gets to grips with a complicated process.

Financing prospects

Financing solar IPPs in the country is expected to be much simpler than coal, despite the pula-denominated PPA and lack of sovereign guarantee. BPC’s average cost of generation including imports was around $0.1/kWh in 2019 and spiked more recently due to an increase in imports. In its tariff application, BPC set out an estimated cost of solar power of P0.9/kWh for the 50MW projects and most analysts expect that to be beaten by the tender.The cost saving for BPC, as well as the likely positive impact on the grid, provides an element of cover for financiers, who expect payments to low-cost generators to continue even if BPC is short of cash.

DFIs are keen to support solar power in the coal and diesel- dominated market, with some credit enhancement and insurance likely alongside loans. The country’s commercial banks are also sufficiently large to fund the projects. Currency risk is also reduced by the pula’s strong correlation to the rand.

As important is the recent award of an investment grade credit rating for BPC from Moody’s. BPC received a Baa2 rating from Moody’s in January with a stable outlook. The outlook was downgraded to negative in June on the back of a change in the outlook for the government’s A2 rating, with strong backing from the government integral to Moody’s BPC rating. One investor told African Energy that a one-notch downgrade would be unlikely to jeopardise the solar procurement.

BPC is helped by a tariff trajectory that aims for cost-reflectivity; tariffs increased by 22% on 1 April and the company has applied for average tariff increases of 5% in April 2021 and 4% in April 2022. At the same time, BPC has been implementing a turnaround plan which saw losses fall from P2bn in 2015 to P72m in 2019, with government subsidies reducing from P2.3bn to P800m over the same period. However, Moody’s pointed out ongoing issues with high levels of debt and a weak financial and liquidity profile without government support, issues at Morupule B and uncertainty about the outcome of repairs, high reliance on imports, and a tariff framework “which has not provided for cost and investment recovery in the past”.

Solar power is expected to fit well with Botswana’s load profile as the country has many air-conditioned buildings.The 90MW Orapa diesel plant will also provide spinning reserve and BPC intends to convert the plant to operate using gas fuel to reduce costs